🤑247capital #20- the jubilee edition | $CLF🤑

Follow-Up, Stock Brothers $CLF, Read of the week - Credit Suisse, Tweets of the Week, ...

Hi Everyone 👋,

Welcome to the #20 issue of 247capital — your weekly source of Investment Research. If you are new, you can join my email list here.

The follow-up to former Issues

Below you´ll find the overview of all bought shares since Issue 1 and the current state. Please keep in mind we´re here for the long run. 5-10 years horizon at least.

$TAP - bought at $44.95 - Issue 1

Closed the week at $53.18 (up 18.31%)🔥

$GEO - bought at $5.79 - Issue 7

Closed the week at $7.14 (up 23.32%)🔥

XTRA:DFV - bought at 12.96€ - Issue 8

Closed the week at 13.04€ (up 0,62%)🔥

READ - bought at 43SEK - Issue 12

Closed the week at 38.46SEK (down 10.56%)❄️

$HIMS - bought at $8.95 - Issue 12

Closed the week at $10.11 (up 12.96%)🔥

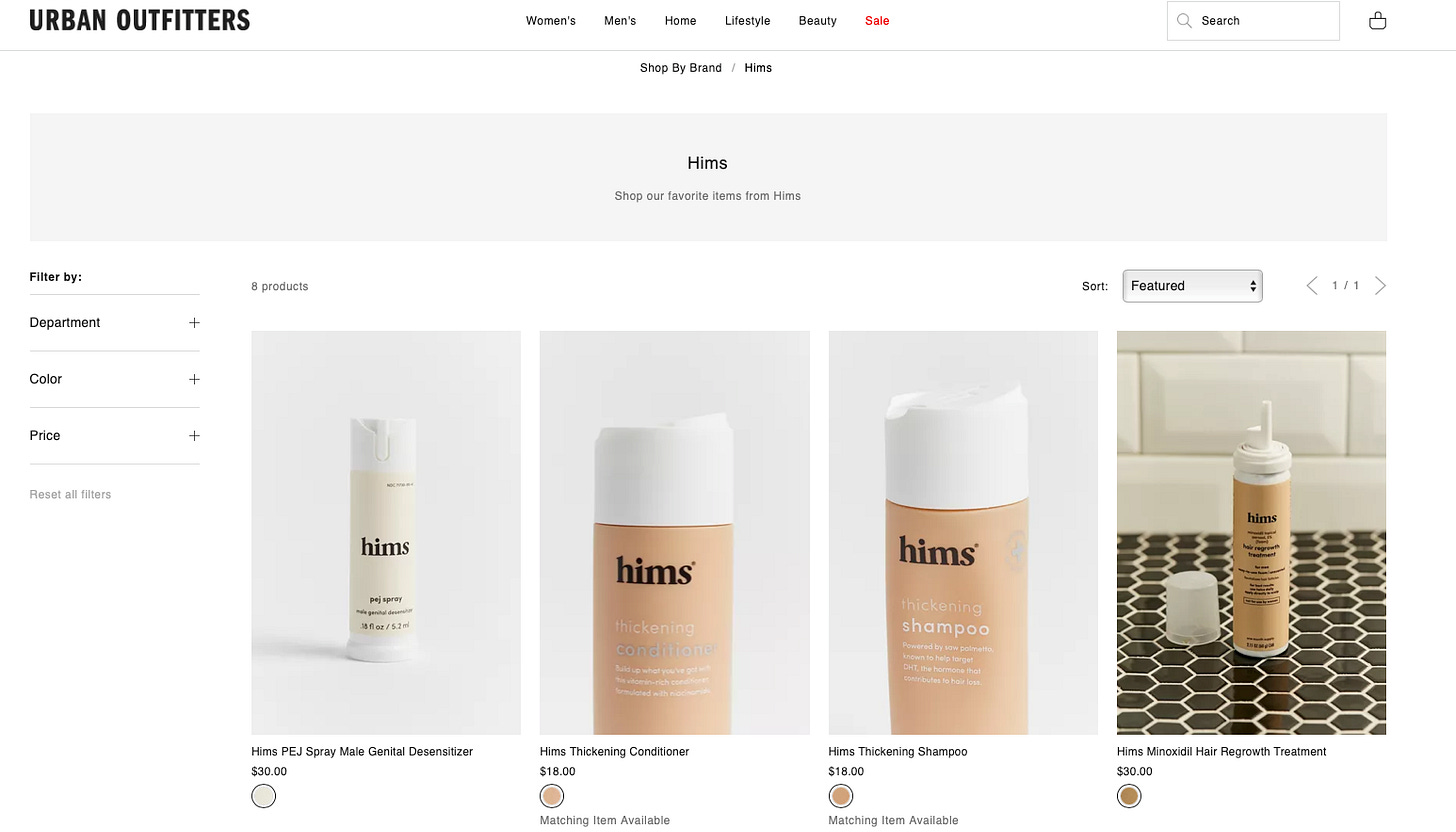

$HIMS announced a partnership with Urban Outfitters. $URBN|MCap: $4B

URBN offers HIMS solutions for skin care and hair loss, sexual health and wellness, supplements, and other personal care items on its website. Both companies expect great synergy, and it’s already implemented 👇🏻

Also, Pop Singer Miley Cyrus is joining as a creative consultant working on the Hers line of prescription skincare products. This will also include advertising and social media content.

If the stock comes back under $10, we are entering the buy zone again.

Stock Brothers - Cleveland-Cliffs Inc. - $CLF

Share price: $22.56 * Market Cap: $11.53B * EPS: -0.11 * P/E Ratio: - * Div: -

Monday, July 13th, 2021 - My brother Florian is back with some new research.

Preface:

Dear readers,

Today I would like to respond to a newsletter subscriber who has great concern about the issues of inflation and expropriation.

Marc contacted me because he read that I have here in the past also dealt with political conditions and followed a relatively conservative investment strategy.

Marc's questions, briefly summarized, are as follows:

What happens to my assets in the event of increased inflation?

How can I protect myself from encroachment and expropriation by governments?

I've had some in-depth discussions with Marc, and for me, I realize Marc is not a fearful guy but very skeptical and distrustful. By the way, these are not negative characteristics in this particular case but rather a subconscious protective instinct.

When investing, each of us makes his experiences over time and draws in retrospect his conclusions. The newsletter subscriber comes from a German-speaking country, and his ancestors have had bad experiences with inflation and expropriation.

Honestly, according to my estimation, one cannot have a positive experience if you are the one who is expropriated. So much for the background of the question.

On the subject of inflation, let me say this much, all-cash assets such as cash, wages, salaries, pensions, life insurance, etc., lose purchasing power through inflation. Tangible assets, on the other hand, increase in value.

Real assets include real estate, raw materials, shares, precious metals, land, etc...

So it is quite advisable not to have too high cash reserves if, for example, there is a comes to a currency reform like the conversion from D-Mark to Euro.

The reader is very skeptical about stocks. He thinks about investing more in precious metals. Since he is still young, he would like to inform himself first of all in all directions.

On the subject of expropriation:

German history has shown that real estate can be expropriated very easily, which is what happened by the government. A building cannot be carried away. Theoretically, perhaps, but practically not.

Thus a real estate, which can be absolutely interesting as an investment, is not protected from expropriation. With precious metals, there are different precious metals, a gold prohibition in the past in Germany and the United States of America. In the USA, gold had to be handed over at a fixed price; the possession was punishable. As always, you will find a more detailed source in the appendix.

There is a German saying which reads:

“Good advice is expensive!”

I want to ask our English-, French-, Spanish-speaking subscribers (and, of course, all other languages, it's logical) to give me feedback if the phrase exists in your language, too. If you have subscribed to the newsletter, you can, of course, continue reading now 😉.

Principal Part:

You might consider the following company:

Cleveland-Cliffs Incorporated |$CLF

The classic question is, what is so exciting about this company concerning the loyal reader? So now I'll ask you the counter-question: Where do I start?

Wikipedia states the following:

"Cleveland-Cliffs Inc. is originally a U.S. mining company and, with a market share of 44% in the USA, it is the largest producer of iron ore pellets. Its most important customers are ArcelorMittal and, until its merger with Cleveland-Cliffs AK Steel of Ohio in December 2019."

Now comes a classic point of corporate research. Do I read the Wikipedia article, and that's it, or do I go deeper with my Curiosity dig deeper? What do you guys think?

Sure, here we go!!!

The article is not up to date, because CLF has also bought the most important customer ArcelorMittal! About ArcelorMittal, I find the following:

"ArcelorMittal is the world's largest steel producer, its output far exceeding that of its next largest European competitors, Thyssenkrupp and Acerinox. (...) On September 28, 2020, it was announced that the company is selling its U.S. business to Cleveland-Cliffs for $1.4 billion."

Commenting on the acquisition, CLF's CEO said:

"Lourenco Goncalves, Chairman of the Board, President, and CEO of Cleveland-Cliffs, will lead the expanded organization. Mr. Goncalves stated: "Steelmaking is a business where production volume, operational diversification, dilution of fixed costs, and technical expertise matter above all else, and this transaction achieves all of these. ArcelorMittal is a world-class organization that we have long admired as our customer and our partner, and we know for a fact that they have taken good care of their US assets."

Mr. Goncalves continued, "We look forward to welcoming the ArcelorMittal USA team into our organization. We create an exceptional company based on great people and are supported by our existing strong relationship with the United Steelworkers, the United Auto Workers, and the Machinists unions. The acquisition of ArcelorMittal USA amplifies our position in the discerning automotive steel marketplace. Further, it improves our position in important U.S. markets such as construction, appliances, infrastructure, machinery, and equipment. It also adds to our strong legacy raw material profile and growing-finishing capabilities. The transaction will enable us to become a more efficient, fully integrated steel system, with the ability to realize all of our operational and financial goals." "

So what kind of company do we find?

It was a commodity mining company (iron ore) in crisis when commodity prices were at rock bottom due to the lockdown, low demand, bought out its 2 largest customers. However, with the acquisition of AK Steel in December 2019, there was no lockdown yet, but an economic downturn was already apparent. Thus, purchases were made in good conditions.

The mined raw materials can therefore be processed directly, which significantly improves the vertical value-adding process. This is referred to as considerable synergy effects. Here is an illustrated volume of this transaction.

"Upon closing of the transaction, Cleveland-Cliffs will be the largest flat-rolled steel producer in North America, with combined shipments of approximately 17 million net tons in 2019. The company will also be the largest iron ore pellet producer in North America, with 28 million long tons of annual capacity."

As the largest producer of hot-rolled flat steel in North America and the largest producer of iron ore pellets, a huge moat is being created in my eyes.

German competitors will not compete because Germany has the world's highest energy prices, and steel production is very energy-intensive. As a result, German competitors will not be able to land in America.

In higher inflation, ownership of the mine will guarantee constant raw material costs for production, but bypassing higher margins can be achieved by passing them on to the customer.

Should a trade war between the U.S. and China occur, CLF would have a monopoly position of sorts. Moreover, by eliminating the cost of transporting iron ore by container ship, there would be an additional competitive advantage over other U.S. competitors.

The automotive industry, the construction industry, the mechanical engineering industry, and many other industries need CLF's products. In addition, the current high raw material prices mean that CLF can significantly increase its margins.

As an important company for the steel supply to the American economy, the state will act protectively here against competitors from abroad. There is no thought of expropriation.

In the event of high inflation, CLF can continue production at any time, as everything from raw materials to steel rolls is in its own hands or manufactured in-house.

Thanks to its market power in North America, CLF also has pricing power, and higher costs can be better passed on to the consumer. CLF will particularly benefit from the planned infrastructure program worth $2.000 billion as this is a very cyclical business. In total, US President Joe Biden's economic stimulus program is worth over a volume of over 5.000 billion US dollars.

Conclusion:

At the height of the crisis in 2020, the exchange rate was $5.16. (However, this lowest price was before the takeover of ArcelorMittal). The current price is about 23 US dollars.

Below 20 dollars, I would look more closely at getting in here; 18 dollars would be nicer.

No matter if Ford, Chrysler, or General Motors sells a car, you know from which steel the car body is most likely to be made of.

Resources:

https://www.handelsblatt.com/finanzen/immobilien/immobilienmarkt-mieten-kaufen-streiten-ueber-enteignungen-wird-weltweit-debattiert/24278962.html?ticket=ST-6746743-bRqdxC9ZSSgWVXKg64WV-ap3

https://www.goldseiten.de/wissen/goldstandard/geschichte/goldverbot.php

https://de.wikipedia.org/wiki/Cleveland-Cliffs

https://de.wikipedia.org/wiki/ArcelorMittal

https://www.businesswire.com/news/home/20200927005083/en/Cleveland-Cliffs-Inc.-to-Acquire-ArcelorMittal-USA

https://www.tagesschau.de/wirtschaft/konjunktur/inflation-verbraucherpreise-usa-103.html

Quote of the Week

“The four most dangerous words in investing are: ‘This time it’s different.'”

- Sir John Templeton

Tweets of the week

Read of the Week - Credit Suisse Global Investment Returns Yearbook 2021 Summary Edition

This report is a 76-page summary version of the full 244-page Credit Suisse Global Investment Returns Yearbook 2021, which is only available in hardcopy upon request.

In the Yearbook, renowned financial historians assess the returns and risks from investing in equities, bonds, cash, currencies, and factors in 23 countries and five different composite indexes since 1900. This year, the database is broadened to include 90 developed markets and emerging markets, and the Yearbook presents an in-depth analysis of nine new markets.

“Many people consider long term to be ten or 20 years. We begin by explaining why much longer periods than this are needed to under- stand risk and return in stocks and bonds. This is because markets are so volatile. The long-run returns on stocks, bonds, bills and inflation over the last 121 years provide the context needed to assess returns over the recent past and to consider likely returns in the future.”

Company names of the week - K

This is a list of company names with their name origins explained.

Today's Top 5 letter K:

Keurig – from the Dutch word keurig. Company co-founder John Sylvan said that once his coffee pod system worked, "he looked up the word excellence in Dutch – because 'everyone likes the Dutch'’"

Kone – Means "machine" or "device" in Finnish.

KPMG – from the last names of the founders of the firms which combined to form the cooperative: Piet Klijnveld, William Barclay Peat, James Marwick, and Reinhard Goerdeler.

KUKA – founded in 1898 in Augsburg, Germany as Keller Und Knappich Augsburg, it shortened its name to KUKA. Today, it is a manufacturer of industrial robots and automation systems.

Kyocera – from Kyoto Ceramics, after Kyoto in Japan

That´s the end of the 20th jubilee edition.

If you like my content so far, you can donate me a coffee here to keep me awake.☕️😁

Got Feedback, Questions, or Suggestions? Just Hit Reply; I’d love to hear your comments.

Until next Monday,

Sebastian from 247capital