Hi Everyone 👋,

Welcome to the #56 issue of 247capital — your weekly 😆 source of Investment Research. If you are new, you can join my email list here or👇🏻

Please hit the heart button ❤️ if you like today’s letter and reply with any feedback.

The follow-up to former Issues

Below you’ll find the overview of all bought shares since Issue 1 and the current state. Please keep in mind we’re here for the long run. 5-10 years horizon at least.

$TAP - bought at $44.95 - Issue 1

Closed the week at $55.61 (up 23.71%)🔥

💰$0.68 dividends

$GEO - bought at $5.79 - Issue 7

Closed the week at $6.78 (up 17.09%)🔥

XTRA:DFV - bought at 12.96€ - Issue 8

Closed the week at 11.90€ (down 8.17%)❄️

READ - bought at 39.25SEK - Issue 12+24

Closed the week at 7.86SEK (down 79.97%)❄️

$HIMS - bought at $8.28 - Issue 12+25

Closed the week at $5.06 (down 38.88%)❄️

THG - bought at 373.50pc - Issue 32+36

Closed the week at 95.14 (down 74.52%)❄️

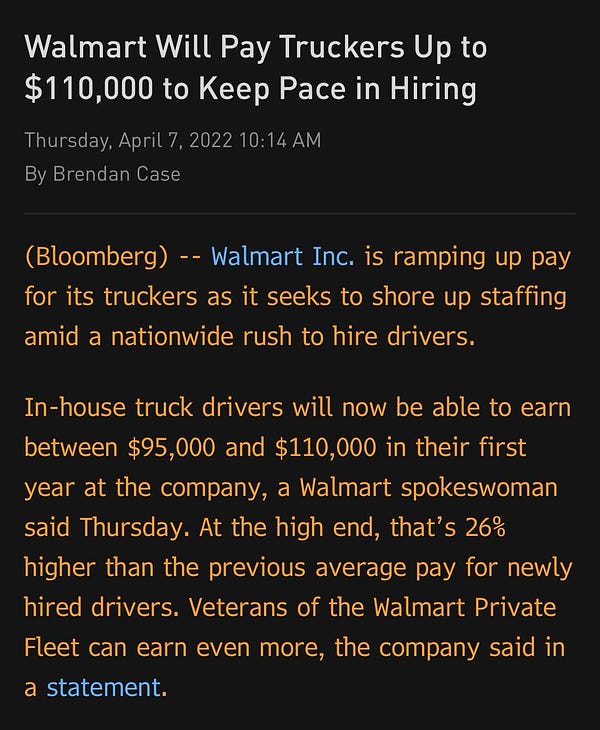

Current situation in one picture/tweet 😆:

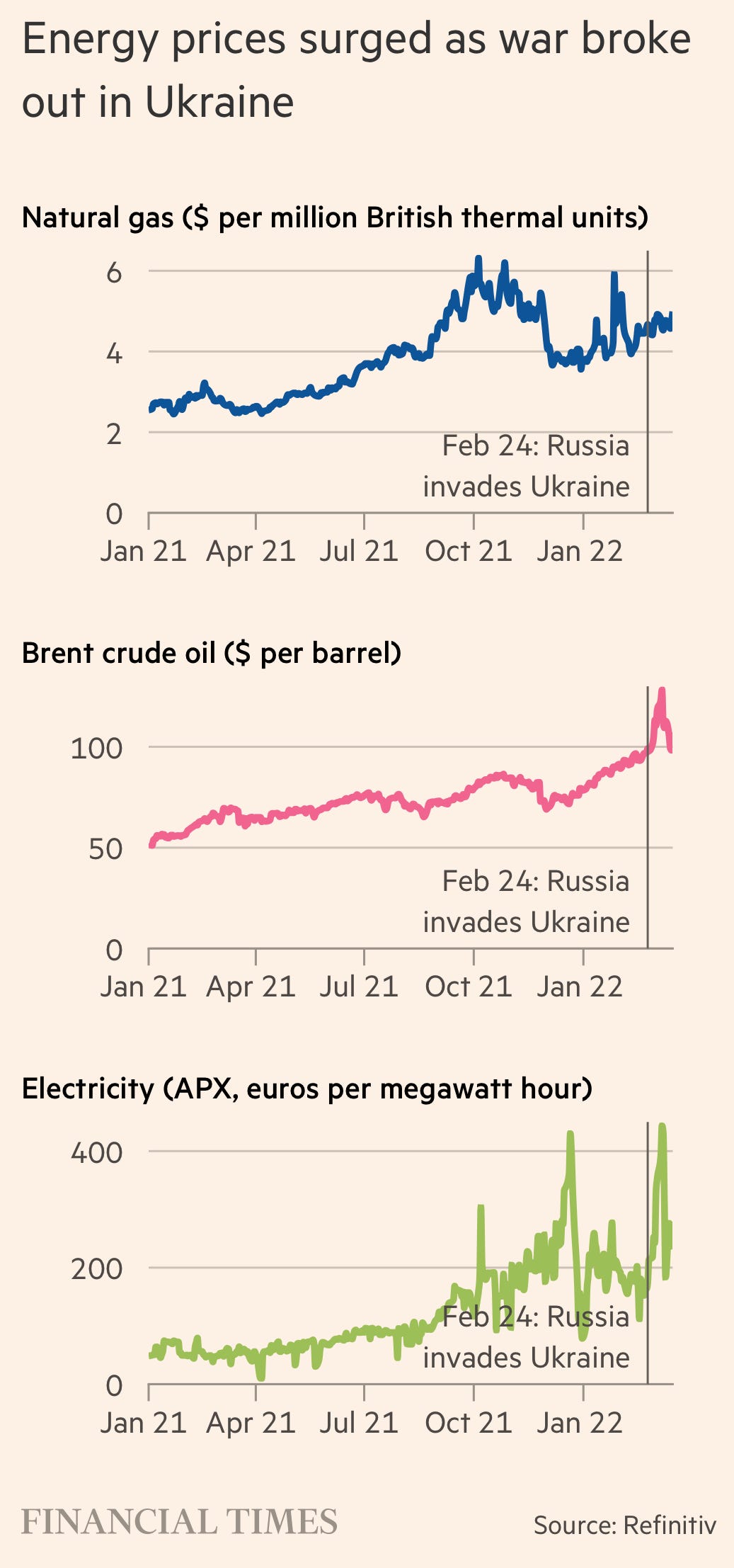

Read of the Week - Financial Times

The global economy’s growing risks: stagflation, refugees and lockdowns.

The Ukraine invasion and new outbreaks of Covid in China are threatening the expected rebound, especially in Europe.

War, above all else, is the ultimate expression of politics. Politicians, rather than business people or bureaucrats, have made decisions that if not reversed, could have

profound implications for the world economy in the short and long term.

— Joseph Capurso, Head of international economics at the Commonwealth Bank of Australia

Quote of the Week

All intelligent investing is value investing... You must value the business in order to value the stock.

— Charlie Munger

Tweets of the week

Thanks for reading, and until next Monday,

Sebastian from 247capital